Would you like to invest in shares but you don’t know how or are these shares simply too expensive for your wallet? Recognizable! The traditional stock market and the stock market seem like a place that is only accessible to the wealthy among us. Although there are of course cheaper shares, some are still quite expensive. As a result, fewer people can invest. This is in contrast to crypto, which is public and accessible to everyone.

Mirror Protocol makes it possible that we can also invest fractionally in these synthetic tokens from now on. How? By minting tokens that reflect the current price of a certain share, everyone can invest in his or her favorite share for just a few euros thanks to blockchain technology. Discover everything about the Mirror Protocol here!

View quickly

- View quickly

- What is Mirror Protocol (MIR)?

- Advantages of blockchain technology

- Oracles

- Mirrored Assets (mAssets)

- How does Mirror Protocol work?

- traders

- Minters

- LP Tokens

- Critical note

- Advantages Mirror Protocol

- Investment share

- Mirror Token

- farming

- Governance

- Team

- Community

- How do I buy Mirror Protocol?

- Conclusion

Watch the video below to find out exactly what the Mirror Protocol is and how it works. You will receive a clear explanation on the basis of animations. At the end of the video you can see how purchasing a mAssets works.

What is Mirror Protocol (MIR)?

Mirror Protocol is a DeFi protocol (dApp) built on the Terra blockchain that allows investing in stocks and other assets using synthetic tokens. The protocol uses a reflection, hence the name, of the current price value of all these assets. Thanks to the use of oracles, among other things , it tracks the value of real-world assets and, thanks to the Mirror Protocol, investors can use the blockchain technology to invest in crypto, gold, as well as in shares on the traditional financial markets. The value of all possible assets can be included in the protocol.

Advantages of blockchain technology

We’ve all heard of Bitcoin (BTC) by now, but we often forget about the innovative technology behind these projects and protocols. Blockchain technology offers numerous advantages in which decentralization is an important part. But also think about speed and privacy. As an investor, we are increasingly wary and therefore want to hand over less and less in order to retain control and power over our own assets.

Oracles

Thanks to blockchain technology, we can use oracles. These oracles form a connection between the real-time world and the blockchain. They collect data and send it to a blockchain . This can be many dates, for example temperature or a specific date of shipment when we want to know more information about a company’s logistics. This data is included in a smart contract, which is then used to decide whether or not to complete transactions.

We can also use this technology to take data, such as the current price of an asset, and bind it to a token. Mirror Protocol is backed by Band Protocol, a cross-chain data oracle backed by stakeholders from Sequoi Capital and Binance, among others. Thanks to various premium data providers, they get an update every 15 seconds, making the price an accurate reflection of the current price. These synthetic tokens are included in the protocol as Mirrored Assets (mAssets).

Mirrored Assets (mAssets)

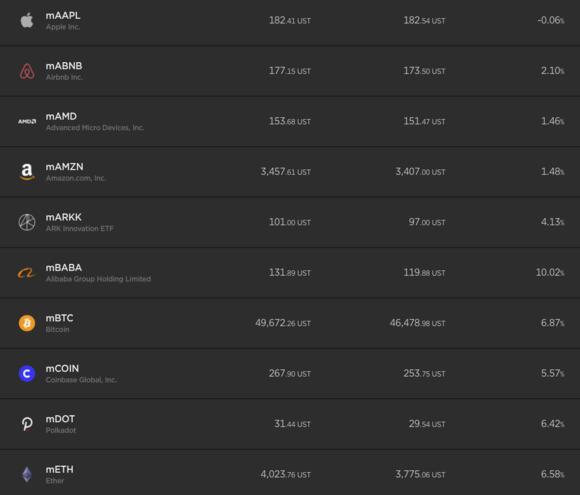

Assets can therefore be minted in the protocol so that investors can start trading them. Think of popular stocks such as Tesla, Airbnb, Netflix and Apple . The ticker of these assets all start with m, which is a point of reference to the Mirror Protocol.

In the overview you can see the price on the Terra blockchain as well as the price of the oracle. The oracles of the Band Protocol make these two values nearly equal. The last percentage is therefore the difference in percentage. Nevertheless, in the example below we still see a difference of 2% with mABNB and even 10% with mBABA. It orakel sends new data every 15 seconds, so that this value is also constantly adjusted.

mirrorprotocol.is

mirrorprotocol.is

With other decentralized applications and protocols, we see that investors can only purchase at a market price. With Mirror Protocol you can set limit orders, so you can determine that you are only willing to invest at a certain price.

How does Mirror Protocol work?

Thanks to the Mirror Protocol, virtually any asset can be tokenized through the use of synthetic tokens. Terra is a fourth-generation blockchain that strives for an open financial infrastructure. The protocol uses the ecosystem’s stablecoin, UST, as collateral for these mAssets.

The protocol welcomes two different types of investors. Those who only want to invest in these synthetic tokens in order to invest in Tesla or Alibaba on the blockchain, for example. And minters, those who create new tokens by providing collateral.

traders

The main users of the protocol are traders. It is they who want to invest in stocks in the form of tokens. In addition to the benefits of blockchain technology, traders from all over the world can use the protocol and are no longer limited by restrictions such as residence or financial status. This makes the bridge between the traditional financial stock market and the crypto landscape . Those who are already active on the crypto market can invest more easily in these synthetic tokens and vice versa. These tokens are cross-chain and can therefore exist on both the Terra and Ethereum blockchains and recently also on the Binance Smart Chain. As a result, there are many more opportunities for investing, farming and active trading.

Minters

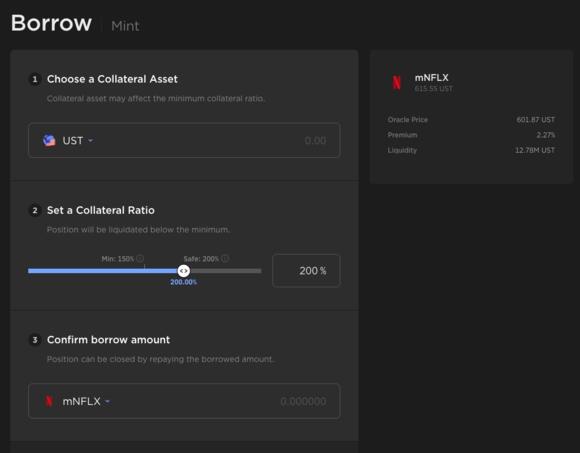

The protocol also allows you to mint assets. To do this you have to provide collateral, which they call ‘ collateralized debt position ‘ (CDP) in the protocol. This percentage is at least 150%. Note that your position will be liquidated if it drops below 150%. That is why it is recommended to do this around 200%. For volatile assets such as game stocks, it is even recommended to choose a collateral of even 300%. This process is also called ‘borrowing’ because here you use one token as collateral, such as UST, and then buy mAssets such as mTesla.

There are several tokens that can be used as collateral:

- UST

- mAssets

- LUNA Tokens, MIR Tokens, ANC Tokens

For example, minting a mAsset Tesla is accompanied by a collateral of 150%. As an example of calculation, if we assume that one share of Tesla is worth $100, we pay the protocol $150. When the price of this asset rises, minters must also increase their collateral to maintain the ratio percentage.

Mirrorprotocol.is

Mirrorprotocol.is

LP Tokens

When you add liquidity to a pool, you receive LP tokens for this. So each pool has a unique LP token. You can use these tokens, which serve as proof that you have provided liquidity to the pool, to start farming. For this contribution , you get rewards that are paid out in native tokens of the protocol: MIR-tokens . Another advantage is that as a liquidity provider you also receive part of the transaction costs.

Thanks to the cross-chain function you can also add liquidity via UniSwap. This has the advantage that more liquidity is available and the pools are therefore larger.

Critical note

We have seen that various tokens can be used as collateral. Normally a stablecoin is considered the most reliable, but we see here that both LUNA and ANC tokens are also used as collateral. However, these are subject to a volatile market and critics wonder whether this is correct. The answer to this is that the ‘collateralized debt position’ is so large that it is in little danger. This is also because your position will be liquidated when minting when it is lower than 150%.

Vladimir Kazakov/Shutterstock.com

Vladimir Kazakov/Shutterstock.com

Advantages Mirror Protocol

In addition to using blockchain technology, there are many other notable benefits. Thanks to Mirror Protocol, we are able to tokenize just about anything. Think of shares, but also, for example, real estate. Because they are located on the blockchain, they are transparent and accessible to everyone.

Investment share

Investing in shares is not for everyone, for many reasons. We see here that you can only invest on the basis of a whole share. Specific? At the time of writing, January 2021, one share of Tesla is equivalent to $1,200. By migrating this share on the blockchain thanks to mAssets, you can already invest in mTesla for any amount. As a result, many more people can invest and therefore low-wage countries can also benefit financially from the success of certain stocks.

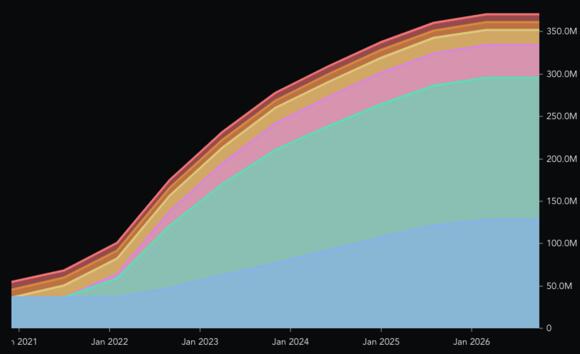

Mirror Token

The Mirror Token (MIR) is the governance token of the ecosystem that offers holders numerous benefits. In total, only a maximum of 370,575,000 MIR tokens will exist, over a time span of up to 4 years. Mirror is a FARM token, which means it is inflationary in that users of the protocol receive it as a reward. This can result in endless rewards and constant minting of new tokens, but the team has deliberately chosen to mint the last tokens within 4 years.

messari.io/asset/mirror-protocol

messari.io/asset/mirror-protocol

farming

The protocol has several liquidity pools where you can add your liquidity. This is via a 1:1 ratio where the value of both assets must be equal in value. One of these assets is standard UST, the stablecoin of the Terra network.

Governance

Investors who own and stake the MIR token can vote on the future of the ecosystem through the protocol. How heavily their vote counts depends on the amount of MIR tokens they stake. With each poll, they can choose how many tokens they use during that specific voting round. At the time of writing, 30.5 million tokens have been staked. With this governance you can also see which polls have already been approved, carried out but also rejected.

Any user of the network can create a poll by paying a certain amount of MIR tokens. If it is not approved, the amount already paid will be divided between the holders who stake their tokens at that time.

Team

Mirror Protocol was launched in late 2020 by Terraform Labs (TFL), based in Seoul. It is also they who developed the Terra blockchain into the ecosystem we know today. Their goal is to enable decentralized payments. In addition, they want to make scalable investments possible for everyone, by means of, among other things, these mAssets.

|

Do Kwon |

Founder & CEO |

With a degree in computer science, Do Kwon quickly developed into the world of crypto and blockchain technology. That his work is successful is confirmed. He managed to get a place in Forbes 30 under 30. |

|

Nicholas Platias |

Head of research |

Nicholas is a co-founder of Guru Labs that focuses on machine learning, mining offline data for certain market insights. He uses this experience as head of research to further develop the Mirror Protocol and the Terra ecosystem. |

|

Mark Goldich |

General Counsel |

Marc has gained experience as a consultant at, among other things, a fintech platform. He assisted investors and clients in developing the legal aspect of crypto, smart contracts and overall blockchain technology. |

Community

The demand for this integration is evident from the success of the Mirror Protocol on their channels. They are especially active on Twitter where they regularly share new updates as well as the latest development. This despite the fact that they do not have an official roadmap. Below is a brief overview of their community:

|

|

87 200 followers |

|

Discord |

6 000 members |

|

Telegram |

14 500 members |

How do I buy Mirror Protocol?

Buying Mirror Protocol on Bitvavo is a piece of cake. Within a few minutes and for less than a euro you can already be the proud owner of MIR.

- Register here for free at Bitvavo

- Verify yourself by clicking on your name in the top right corner and then go to ” Verification “.

- Transfer money via iDeal. You do this by clicking on ” Deposit Euros “.

- Then enter the amount and choose iDeal as payment option so that the money is in your Bitvavo account within a minute. Then click on “Pay”.

- If you click on ” Overview ” afterwards, you will see the money.

- Find MIR, click on it and then press “Buy”.

- Invest the amount you have in mind in MIR.

- Congratulations! You bought MIR!

Don’t forget to save your username and password

Conclusion

More and more investors are finding their way to crypto and are seeing the benefits of blockchain technology. Because of this transparency and accessibility, anyone worldwide with an internet connection can use the crypto market and also invest themselves. This is not the case when looking at the traditional stock market and stock market.

If we look at the development of the digital economy, tokenizing various assets is a big step forward. Blockchain technology can be used to migrate all kinds of assets on the blockchain, from stocks to real estate. These are then accessible to anyone with an internet connection , thanks to the world of DeFi.

Because you can invest fractionally, you are no longer tied to the price of a whole share. For example, Tesla shares are not accessible to people who do not have the financial means to make this investment come true. Thanks to the Mirror Protocol you can already invest for a small amount in your favorite share , which you can now find on the blockchain!

Do you have any questions about the Mirror Protocol? Ask us in our AllesOverCrypto Facebook group where we now have more than 100,000 members! You can also easily find the answer to a question about crypto in our FAQs. Furthermore, you can also find a lot of information by googling your question + AllesOverCrypto.

Header image: Karnoff/Shutterstock.com

Do you want to trade like a real crypto expert?

Get exclusive trading signals and get maximum profit!

Start today!

IMG