PLEASE NOTE: This ICO did not take place. This article is purely informative if the project continues in the future.

Would you like to invest in real estate, but do you have insufficient capital at your disposal? The Dutch company MijnVastgoed is going to tokenize the real estate market, making it possible to invest in investment homes with as little as ten euros. Knowing more? Then read the explanation about the platform in this article.

View quickly

- Company behind the ICO

- Why real estate?

- The idea of MijnVastgoed

- About the ICO

- Team

- roadmap

- Finally

Company behind the ICO

|

Company name |

Mijn-vastgoed.nl BV |

|

Address |

Mayor Koomansplein 1 |

|

|

[email protected] |

|

Phone |

020-2440890 |

|

Chamber of Commerce number |

69497540 |

Why real estate?

Saving money and thus building wealth has always been an important life lesson from our parents. In fact, we have come to a time when this teaching is more important than ever before. Where we used to be convinced that a pension and a contribution from the state was enough to provide us with wealth in old age, there is now a lot of uncertainty about this. There is a growing awareness that people must take 100% responsibility for their own finances. But how do you do this? So how can you save properly for your retirement? You can throw your money into the many turbos and sprinters, but there is a strong chance that you will be left empty-handed. How can you grow your money without having to take a lot of risk? A frequently given answer to this is ‘investing in real estate’. “Buy a nice apartment or cross the border for a holiday home”. Why is this such a good choice?

The advantages of real estate at a glance:

- You enjoy rental income every month

- You know exactly what it will yield and can therefore determine what costs you can incur

- There is a shortage of houses in the Netherlands. When demand is higher than supply, prices rise

- You buy the house privately and therefore you do not have to pay tax on an increase in the value of the property

- The volatility of the investment is low

But what if you don’t have the starting amount to buy that apartment on the corner of the street? Then this was normally already the end of this fairy tale. If it’s up to MijnVastgoed not, they come up with a solution.

The idea of MijnVastgoed

MijnVastgoed wants to ensure that everyone can participate in the real estate market, even for those who want to invest a maximum of 100 euros. They do this by developing an online platform on which investments in individual investment properties can be divided into blockchain tokens. This makes it possible to finance part of a building. Subsequently, rental income and increases in value will be divided proportionally via smart contracts.

Example:

You buy €1000 worth of real estate tokens and acquire 0.5% of the property. If the rental income per month is €800 and after a year the property has increased in value by €10,000, you have achieved a return of 9.8% that year.

((0.5% * (800*12)) + (0.5%*10,000)) = 48 + 50 = €98

With an investment of €1000, this makes a return of 9.8%.

Advantages of investing with tokens

Investing in real estate through tokens has a number of advantages compared to actually purchasing an apartment yourself:

- The tokens can be bought and sold at any time. The tokens therefore make your investment more liquid. This is in contrast to the current real estate funds or the actual purchase of an investment home.

- The real estate market is an ‘us-knows-us’ market where the most profitable homes are already being traded among themselves. It is difficult to get into this world and therefore you are forced to choose from second-class housing.

- There is a lot to consider when purchasing an investment property, such as notaries and estate agents. The related costs are often confusing and incomprehensible to a layperson.

- The rental of the property is already done for you by MijnVastgoed. This means you don’t have to make an effort to find a new tenant.

- You don’t have to worry about the house yourself, you don’t have to do the maintenance and you don’t have to ask questions from the tenants.

- No administrative hassle such as arranging rental contracts

The following video explains the idea well:

How does the platform work?

For the buyer

Investments in investment properties are offered separately on the platform. Each investment home has different financial characteristics. For example, the purchase price, the term and the interest offered differ per home. On the platform, visitors can filter homes by region, location, purchase price, yield and duration. In this way, every visitor can determine for himself what the ideal investment home is. Each property that has yet to be sold on the platform indicates a time period in which the visitor can register. It also shows for a house what percentage of investments is still available for this specific house.

For the seller

The owner/seller of an investment property can offer his property on the MijnVastgoed online platform. The seller makes use of a unique feature of the MijnVastgoed concept, namely that the seller can still claim part of the added value when MijnVastgoed sells the house again. To guarantee the quality of the platform, various formal requirements are imposed on the seller for offering his investment home. You can think of a minimum of information provision, documentation and a good photo report. The seller can choose to do this himself or, at an additional cost, to have this done by a sales broker from MijnVastgoed. Once a sufficient number of buyers have registered, MijnVastgoed will purchase the home (usually in combination with a bank loan) and pay interest on a pro rata basis. to the token holders. MijnVastgoed becomes the legal owner of the investment home. At the end of the term, MijnVastgoed sells the investment home and buys back the blockchain tokens, in the event of a possible added value, this will be for a higher amount than when the customer purchased the tokens.

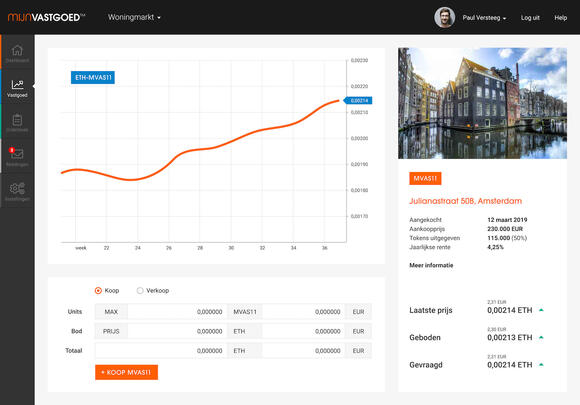

This is an indication of what the platform will look like:

IMG

About the ICO

MijnVastgoed has decided to hold an ICO in order to attract a nice start-up capital. Dividend tokens will be sold during this ICO. Owners of these tokens are entitled to dividends from the company’s operations.

AFM supervision

The Netherlands Authority for the Financial Markets (AFM) closely monitors ICOs. For example, it is important that the tokens issued represent a clear value rather than a right to a provider’s future service. At MijnVastgoed, the right to dividend concerns the value of the dividend token. Because they arrange it in this way, they fall under the Financial Supervision Act (Wft).

PLEASE NOTE: This ICO did not take place. This article is purely informative if the project continues in the future.

Overview ICO data

|

Dividend Token Features |

|

|

When does the ICO run? |

1 June 0:00 AM to 31 June 2018 11:59 PM |

|

Which currencies are accepted? |

Euros and Ethereum |

|

Minimum investment |

250 Euro or 0.75 Ethereum |

|

Price during ICO |

€0.015 |

|

token type |

ERC-20 (based on the Ethereum protocol) |

|

Soft cap ICO |

€0.45 million (900 Eth). |

|

Hard cap ICO |

€1.5 million (2600 Eth) |

|

Maximum issuance tokens |

100 million dividend |

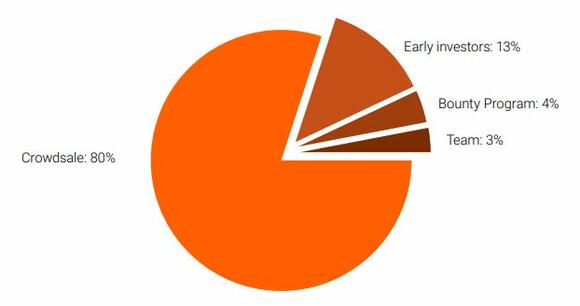

All 100 million tokens are distributed according to this pie chart

All 100 million tokens are distributed according to this pie chart

Use of the collected capital

|

€0 – €450,000 |

Development online platform |

|

€450,000 – €800,000 |

Financial buffer for future customers |

|

€800,000 – €1,500,000 |

Strategic acquisition and/or assistance with the purchase of an investment home |

Difference dividend tokens and real estate tokens

During the token sale, the dividend tokens are sold. These entitle the holder to dividends from future business operations of MijnVastgoed BV. The real estate tokens can be purchased later via the online platform. These tokens are used to invest in individual investment properties.

Team

The MijnVastgoed team consists of six people led by Hanjo Mastenbroek. Mr. Mastenbroek is an entrepreneur and visionary and will use his expertise to make MijnVastgoed™ a success. He is assisted in this by the team consisting of two blockchain software developers, a web developer & graphic designer, a marketer and a communication specialist. They are supported by two advisors in financial supervision and brokerage. Together they will work according to the roadmap below.

roadmap

Goals for Q3 2018

-

- Development of the platform

- Development user environment of the online platform

- Increasing the tradability of the token by getting it on exchanges

Goals for Q4 2018

- Recruitment of investment properties

- Further development of the platform

- Further development of the user environment of the platform

Goals for Q1 2019

-

- Launch of the online platform

- AFM compliance

- Offering investment properties

Goals for Q2 2019

- Approval prospectus AFM

- The first investment properties successfully tokenized

Goals for Q3 2019

-

- Growth to offer 100+ investment properties

Goals for Q4 2019

- Growth to offer 100+ investment properties

Finally

PLEASE NOTE: This ICO did not take place. This article is purely informative if the project continues in the future.

Many studies have shown that real estate is a solid investment. The liquidity of this investment and the requirement to have a lot of your own money are off-putting to many people. It therefore seems that MijnVastgoed will fulfill the wishes of many (small) investors with its blockchain platform. However, everything is still in its infancy and money must first be raised before they can get started.

Sources

Website

WhitepaperHow to invest in real estate