Digital asset management company CoinShares has published its weekly report on the flows of funds for the cryptocurrency market. highlight of the report, released on October 11, is that the amount of new capital inflows has doubled in the past week.

Most of this influx went into bitcoin, which continues to dominate the new capital at $ 225 million.

Compared to last week, this represents an increase of more than double, as the first week of October saw an inflow of $ 90 million in total. This occurred despite the cryptocurrency ban in China, which occurred in the last week of September, with an influx of $ 95 million. Over a two-month period, total inflows reached $ 638 million, which CoinShares notes is only below the all-time high.

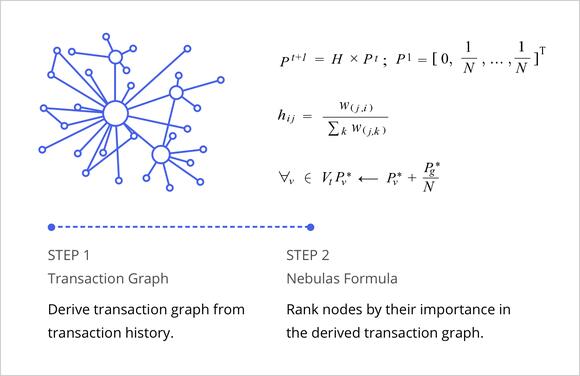

Flows per asset: CoinShares

Digital Asset Fund Flows Weekly covers investment inflows and outflows in several of the major investment vehicles. se included exchange-traded products, mutual funds, and OTC trusts associated with bitcoin and other cryptocurrencies.

Other assets that are registering increases are Solana and Cardano, with 12.5 million dollars and 3 million dollars respectively. Ethereum, on the other hand, saw a $ 14 million outflow. Polkadot, Litecoin and Ripple, which are in the middle of a lawsuit with the SEC, have also experienced minor exits.

Could Legislators’ Statements Be Behind Cryptocurrency Inflows?

CoinShares has suggested that statements by SEC Chairman Gary Gensler showing tentative support for an ETF based on the future of bitcoin could be behind the increased influx. Sure enough, the SEC and other regulators are working on a framework, but the exact nature of their framework is unclear.

Read also Ethereum Rival Polkadot marks Parachain milestone with 25% price increase

United States, of which many countries will surely follow in the footsteps of regulation, will have a great impact on the market. However, despite Gensler’s attempt to support some companies, the United States is unlikely to leave the free market. For example, stablecoins will receive regulation as the US Treasury sees problems within the growing sector.

That said, both retail and institutional investors are happy to see progress in terms of regulation. belief is that regulation will bring some order to the market and strengthen investor protection, a point of contention that regulators are very focused on.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action taken by the reader on the information found on our website is strictly at your own risk.

Source link

more